M2G 1.1 Background

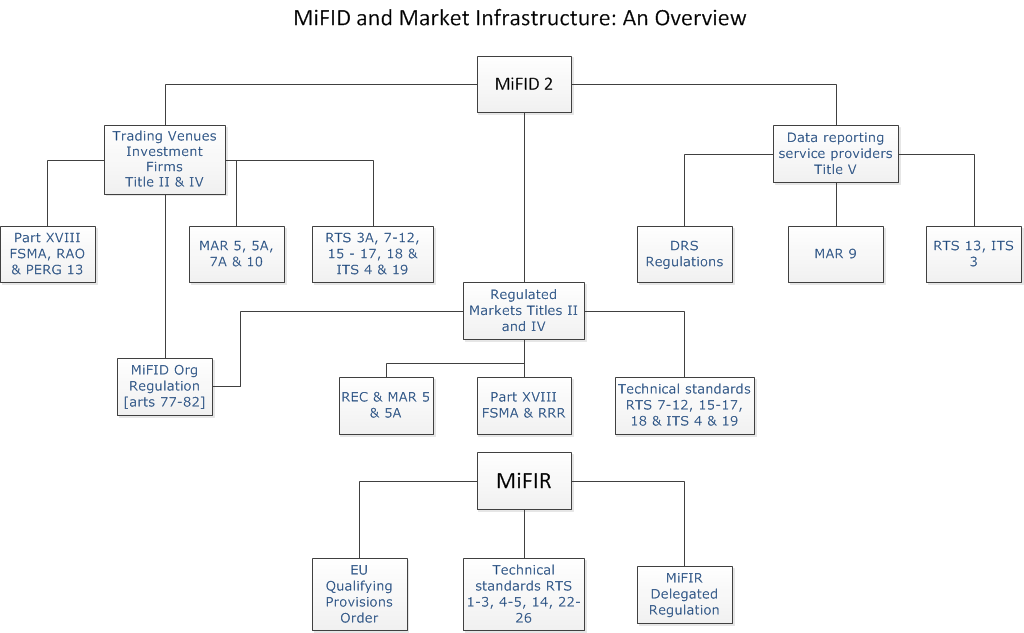

1This guide sets out an overview of the FCA’s approach to onshoring2 of the recast Markets in Financial Instruments Directive 2 (MiFID 2) in the MAR and REC sourcebooks. 2. “Onshoring”, for these purposes, refers to the process by which law deriving from EU legislation at IP completion day is retained or adapted, post IP completion day.2 This guide focuses on the regulatory regime in MiFID 2 for UK2 trading venues (as defined by 2(16A) MiFIR2: this term comprises UK2 regulated markets, multilateral trading facilities and organised trading facilities but not systematic internalisers) and UK2 data reporting services providers (DRSPs))2.

1MiFID 2 enables the Commission to make secondary legislation in several places. That legislation takes the form of a combination of delegated acts (for example as provided for in article 4(2) MIFID to specify elements of the definitions), regulatory technical standards (RTS) and implementing technical standards (ITS). Delegated acts under MiFID 2 are both drafted and made by the Commission, after it receives advice from the European Securities and Markets Authority (ESMA), and may take the form of either directives or directly applicable regulations. As for RTS and ITS, these are prepared in draft by ESMA and subject to public consultation, before endorsement and making by the Commission; both take the form of regulations and so are directly applicable. RTS and ITS feature, in particular, in the MiFID 2 provisions relating to trading venues and DRSPs. After IP completion day, in the United Kingdom, in broad terms, the former role of the Commission is discharged by the Treasury and ESMA’s functions are performed by the FCA. For further details, see the Financial Regulators’ Powers (Technical Standards etc.) (Amendment etc.) (EU Exit) Regulations 2018.2

1You can be subject to a MiFID derived2 or MiFIR requirement, even if you are not an authorised financial institution. regulation 30 of the Financial Services and Markets Act 2000 (Markets in Financial Instruments) Regulations 20172 applies algorithmic trading requirements to certain persons exempt under MiFID, where they are members of a regulated market or multilateral trading facility (article 1(5) MiFID). Similarly, article 1 MiFIR requires non-financial counterparties above the clearing threshold in article 10 of the European Market Infrastructure Regulation (‘EMIR’) (Regulation 648/2012/EU. See our EMIR webpage (https://www.fca.org.uk/markets/emir) for further details about non-financial counterparties and the clearing threshold) to comply with the obligations in Title V MiFIR. This means trading certain classes of derivatives on organised venues only, UK2 regulated markets, UK2 multilateral trading facilities (MTFs), UK2 organised trading facilities (OTFs) and permitted third country venues (article 28 MiFIR). EEA venues are treated as third country venues for these purposes.2