COBS 19 Annex 3 1Format for annuity information

This annex belongs to COBS 19.9.7R(3) and COBS 19.9.15R(3)(c).

1 |

Format of bar graph in the Part 1 template |

||

1.1 |

Format of bar graph (where annual income is depicted)2 |

||

1.1.1 |

When a firm is creating the two bar graphs as set out in Part 1, the firm must ensure: |

||

(1) |

the annual income offered by the pension annuity in the guaranteed quote is presented on the left hand side of the two bar graphs; |

||

(2) |

the2 y-axis must: |

||

(a) |

start with a monetary value which is £20 below the annual income of the pension annuity being offered by the firm in the guaranteed quote; |

||

(b) |

use a scale which clearly and fairly depicts the difference in annual income that a retail client will obtain if a market-leading pension annuity quote is accepted; and |

||

(c) |

not include any numbers or details which are not required by the rules in COBS 19.9 or the provisions of this annex. |

||

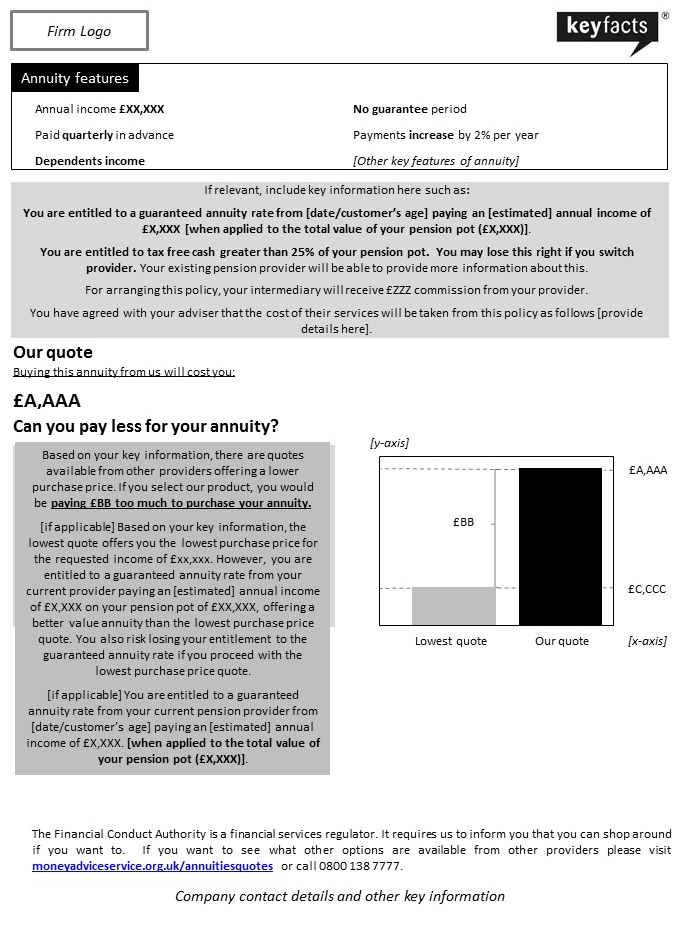

21.2 |

Format of bar graph in Part 4 (where the purchase price of the pension annuity is depicted) |

||

21.2.1 |

When a firm is creating the two bar graphs as set out in Part 4, it must ensure: |

||

(1) |

the lowest purchase price of the pension annuity offered by the market-leading quote is presented on the left-hand side of the two bar graphs with the higher purchase price in the firm’s guaranteed quote appearing on the right-hand side; |

||

(2 |

the y-axis must: |

||

(a) |

start with a monetary value which is £20 below the purchase price of the lowest pension annuity quote; |

||

(b) |

use a scale which clearly and fairly depicts the difference in the purchase price of the pension annuity offered by the market-leading quote and the firm’s guaranteed quote; and |

||

(c) |

only include numbers or details which are required by the rules in COBS 19.9 or the provisions of this annex. |

||

Part 1: Template for cases where the guaranteed quote does not provide highest annual income

Where the guaranteed quote does not provide the highest annual income

Part 2: Template for cases where the guaranteed quote, the guaranteed annuity rate, a guaranteed minimum pension or section 9(2B) rights offer the highest annual income

Where a guaranteed quote, a guaranteed annuity rate, a guaranteed minimum pension or section 9(2B) rights offers the highest annual income

Part 3: Template for cases where the a retail client refuses to answer questions to determine whether the client is eligible for an enhanced annuity, or2 does not consent to a market-leading quote being generated

Where the retail client refuses to answer questions to determine whether the client is eligible for an enhanced annuity, or2 appropriate consent has not been given to allow a firm to generate a market-leading quote

2Part 4: Template for cases where the market-leading quote offers the lowest purchase price pension annuity

Where the market-leading quote offers the lowest purchase price

2Part 5: Template for cases where the income quote or the application of a retail client’s guaranteed annuity rate offers the lowest purchase price pension annuity

Where the income quote or a guaranteed annuity rate offers the lowest price pension annuity

2Part 6: Template for cases where the retail client refuses to answer questions to determine whether the client is eligible for an enhanced annuity, or does not consent to a market-leading quote being generated

Where the retail client refuses to answer questions to determine whether the client is eligible for an enhanced annuity, or appropriate consent has not been given to allow a firm to generate a market-leading quote