COBS 19.1 Pension transfers, conversions, and opt-outs5

Application

[deleted]7

Except where a firm is providing abridged advice (see COBS 19.1A), this section applies to a firm which:10

7- (1)

gives advice on pension transfers, pension conversions and pension opt-outs to a retail client; or10

- (2)

arranges pension transfers, pension conversions or pension opt-outs,10

in relation to:

- (3)

- (4)

a pension conversion; or10

- (5)

a pension opt-out from a scheme with safeguarded benefits or potential safeguarded benefits10.

7A firm should comply with this section in order to give appropriate independent advice for the purposes of section 48 of the Pension Schemes Act 2015.

Requirement for pension transfer specialist

- (1)

7A firm must ensure that advice on pension transfers, pension conversions and pension opt-outs is given or checked by a pension transfer specialist.

- (2)

The requirement in (1) does not apply where the only safeguarded benefit involved is a guaranteed annuity rate.

Role of the pension transfer specialist when checking

7When a firm uses a pension transfer specialist to check its proposed advice on pension transfers, pension conversions and pension opt-outs, it should ensure that the pension transfer specialist takes the following steps:

- (1)

checks the entirety and completeness of the advice;

- (2)

confirms that any personal recommendation is suitable for the retail client in accordance with the obligations in COBS 9.2.1R to 9.2.3R and including those matters set out at COBS 19.1.6G; and

- (3)

confirms in writing that they agree with the proposed advice before it is provided to the retail client, including any personal recommendation.

Personal recommendation for pension transfers and conversions

- (1)

7A firm must make a personal recommendation when it provides advice on conversion or transfer of pension benefits.

- (2)

Before making the personal recommendation the firm must:

- (a)

determine the proposed arrangement10 with flexible benefits to which the retail client would move; and

- (b)

carry out the appropriate pension transfer analysis and produce the transfer value comparator10.

7

- (a)

- (3)

The requirement in (2)(b) does not apply if the only safeguarded benefit involved is a guaranteed annuity rate7.

- (4)

The firm must take reasonable steps to ensure that the retail client understands how the key outcomes from the appropriate pension transfer analysis and the transfer value comparator10 contribute towards the personal recommendation.7

- (5)

Prior to making a personal recommendation to effect a pension transfer or pension conversion, a firm must obtain evidence that the client can demonstrate that they understand the risks to them of proceeding with the pension transfer or pension conversion.10

- (1)

COBS 9 contains suitability requirements which apply if a firm makes a personal recommendation in relation to advice on conversion or transfer of pension benefits.10

- (2)

- (a)

COBS 9 requires a firm to obtain from the client necessary information for the firm to be able to make a recommendation. The necessary information includes ensuring that the client has the necessary experience and knowledge to understand the risks involved in the transaction. If a client does not understand the risks and/or the firm does not have evidence that the client can demonstrate their understanding, then it is likely not to be appropriate, under the COBS 9 requirements, to make a recommendation to transfer or convert. 10

- (b)

The firm should make a clear record of the steps it has taken to satisfy itself on reasonable grounds that it has adequate evidence of the client’s demonstration of their understanding of the risks.10

- (a)

- (3)

When a firm is obtaining evidence as to whether the client can demonstrate that they understand the risks involved in the pension transfer or pension conversion, it should tailor its approach according to the experience, financial sophistication and/or vulnerability of each individual client. 10

Appropriate pension transfer analysis

7To prepare an appropriate transfer analysis a firm must:

- (1)

assess the benefits likely to be paid and options available under the ceding arrangement10;

- (2)

compare (1) with those benefits and options available under the proposed arrangement;10

- (3)

where the proposed arrangement is a personal pension scheme, stakeholder pension scheme or defined contribution occupational pension scheme that is not a qualifying scheme, and a qualifying scheme is available to the retail client, compare the benefits and options available under the proposed arrangement with the benefits and options available under the default arrangement of the qualifying scheme; and10

- (4)

undertake the analysis in (1), (2) and (3) in accordance with COBS 19 Annex 4A and COBS 19 Annex 4C.10

7 COBS 19.1.1-AR and COBS 19.1.2BR do not preclude a firm from preparing other forms of the analysis (for example, stochastic cashflow modelling) which are relevant to making a personal recommendation to the retail client, as long as projected outcomes at the 50th percentile are no less conservative than if the analysis had been prepared in accordance with COBS 19 Annex 4A and COBS 19 Annex 4C.

- (1)

7This guidance applies if a firm presents information in the appropriate pension transfer analysis10 which considers the impact of:

- (a)

the Pension Protection Fund and the FSCS; or

- (b)

scheme funding or employer covenants.

- (a)

- (2)

If a firm presents the information in (1) it should, in accordance with Principle 7 and the fair, clear and not misleading rule, do so in a way that is balanced and objective.

- (3)

If a firm does not have specialist knowledge in assessing the impact of (1)(a) or 1(b), it should consider not including the information.

- (1)

7This guidance applies if a firm presents information in the appropriate pension transfer analysis10:

- (a)

that contains an indication of future performance; and

- (b)

is produced by a financial planning tool or cash flow model that uses different assumptions to those shown in the key features illustration for the proposed arrangement10.

- (a)

- (2)

A firm presenting the information in (1) should explain to the retail client why different assumptions produce different illustrative financial outcomes.

Transfer value comparator

- (1)

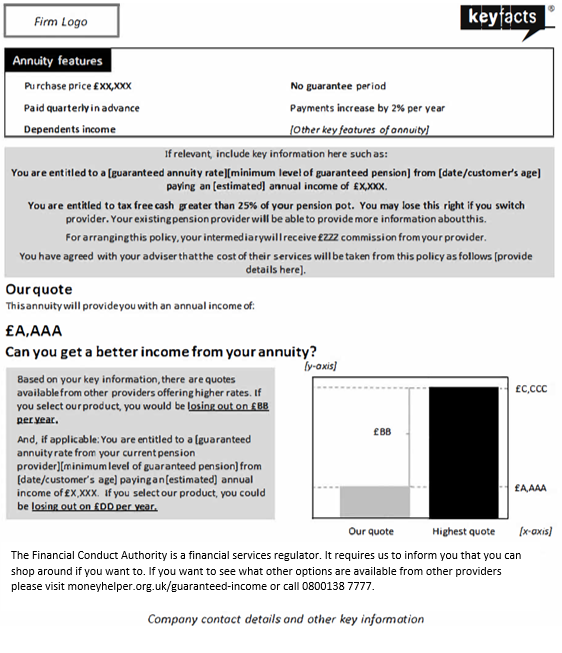

7To prepare a transfer value comparator10, a firm must compare the transfer value offered by the ceding arrangement10 with the estimated value needed today to purchase the future income benefits10 available under the ceding arrangement10 using a pension annuity (calculated in accordance with COBS 19 Annex 4B and COBS 19 Annex 4C).

- (2)

The firm must provide the transfer value comparator to the retail client in a durable medium using the format and wording in COBS 19 Annex 5 and using the notes set out in COBS 19 Annex 5 1.2R.10

- (3)

When the retail client has passed the normal retirement age of the ceding arrangement, the firm must provide a transfer value comparator applying the retirement age assumed in the calculation of the transfer value.10

- (4)

Where the ceding arrangement allows the retail client to take their benefits at an age below the scheme’s normal retirement age, with no reduction for early payment and where no consent is required, then the firm must provide a transfer value comparator assuming that the retail client will retire at this age. 10

Guidance on estimated transfer value

10If a firm gives advice on conversion or transfer of pension benefits to a retail client under circumstances where the ceding arrangement is expected to be changed, or replaced by another scheme, the firm should:

- (1)

prepare a provisional appropriate pension transfer analysis and transfer value comparator based on the information related to the changed or replacement scheme;

- (2)

make reasonable assumptions about the changed or replacement scheme where the benefits are uncertain; and

- (3)

set out in a provisional suitability report any assumptions and uncertainties to the retail client, which should clearly set out that the personal recommendation can only be finalised once the transfer value and changed or replacement arrangements are certain.

Guidance on assessing suitability

-

(1)

The guidance in this section relates to the obligations to assess suitability in COBS 9.2.1R to 9.2.3R.7

-

(2)

When a firm is making a personal recommendation for a retail client who is, or is eligible to be, a member of a pension scheme with safeguarded benefits and who is considering whether to transfer, convert or opt-out, a firm should start by assuming that a transfer, conversion or opt-out will not be suitable.7

-

(3)

A firm should only consider a transfer, conversion or opt-out to be suitable if it can clearly demonstrate, on contemporary evidence, that the transfer, conversion or opt-out is in the retail client’s best interests.7

-

(4)

To demonstrate (3), the factors a firm should take into account include:7

- (a)

the retail client’s intentions for accessing pension benefits;7

- (b)

the retail client’s attitude to, and understanding of the risk of giving up safeguarded benefits (or potential safeguarded benefits) for flexible benefits, taking into account the following factors:9

7- (i)

9the risks and benefits of staying in the ceding arrangement;

- (ii)

9the risks and benefits of transferring into an arrangement with flexible benefits;

- (iii)

9the retail client’s attitude to certainty of income in retirement;

- (iv)

9whether the retail client would be likely to access funds in an arrangement with flexible benefits in an unplanned way;

- (v)

9the likely impact of (iv) on the sustainability of the funds over time;

- (vi)

9the retail client’s attitude to and experience of managing investments or paying for advice on investments so long as the funds last; and

- (vii)

9the retail client’s attitude to any restrictions on their ability to access funds in the ceding arrangement10;

- (i)

- (c)

the retail client’s attitude to, and understanding of investment risk;7

- (d)

the retail client’s realistic retirement income needs including:7

- (i)

how they can be achieved; 7

- (ii)

the role played by safeguarded benefits (or potential safeguarded benefits) in achieving them; and 7

- (iii)

the consequent impact on those needs of a transfer, conversion or opt-out, including any trade-offs; and7

- (i)

- (e)

alternative ways to achieve the retail client’s objectives instead of the transfer, conversion or opt-out.7

- (a)

- (5)

9If a firm uses a risk profiling tool or software to assess a retail client’s attitude to the risk in (4)(b) it should:

- (6)

9When a firm asks questions about a retail client’s attitude to the risk in 4(b) it should consider the rules on communicating with clients (COBS 4), which require a firm to ensure that a communication is fair, clear and not misleading.

-

(7)

Where a qualifying scheme is available to the retail client, a firm considering making a personal recommendation to effect a pension transfer to a personal pension scheme, stakeholder pension scheme or defined contribution occupational pension scheme that is not a qualifying scheme:10

- (a)

should start by assuming that it will not be as suitable as a transfer to the default arrangement of an available qualifying scheme; and10

- (b)

will need to be able to demonstrate clearly that, as at the time of the personal recommendation, it is more suitable than a transfer to the default arrangement of an available qualifying scheme.10

- (a)

-

(8)

For the purposes of (7):10

- (a)

a qualifying scheme is available to the retail client where it accepts transfers from other schemes into its default arrangement; and10

- (b)

where more than one qualifying scheme is available to the retail client, the firm should consider the available qualifying scheme that the retail client most recently joined, but may, in addition, also consider any of the other qualifying schemes available to the retail client.10

- (a)

-

(9)

To demonstrate (7)(b) the firm may, subject to (10), take into account one or more of the following considerations:10

- (a)

the retail client provides evidence of experience at making active investment choices as a self-investor or as an advised investor (except in relation to investments in the default arrangement of a qualifying scheme or in a mortgage endowment policy or similar product);10

- (b)

where the retail client wishes to access the funds within 12 months of entering into pension decumulation and the qualifying scheme does not offer the retail client a decumulation option that would enable the retail client to achieve their desired outcome.10

- (a)

-

(10)

In taking into account the considerations in (9), as well as any other considerations that the firm may decide to take into account when demonstrating 7(b), the firm should also consider:10

- (a)

whether those considerations are so important to the client as to outweigh other considerations in favour of the default arrangement of the available qualifying scheme; and10

- (b)

why the outcome sought by transferring to a personal pension scheme, stakeholder pension scheme or defined contribution occupational pension scheme that is not a qualifying scheme cannot be achieved by transferring to the qualifying scheme.10

- (a)

-

(11)

The presence of one or more of the following circumstances should not be taken as sufficient to demonstrate that the personal recommendation in (7) is suitable: 10

- (a)

one of the retail client’s objectives is to have access to a wider range of investment options than available under the default arrangement of the qualifying scheme;10

- (b)

the transfer is to take place more than 12 months before the retail client enters into pension decumulation; and/or10

- (c)

the retail client will enter into pension decumulation within the next 12 months, but the retail client has not yet decided whether or how they will access their funds. 10

- (a)

Working with another adviser

- (1)

9This guidance relates to the obligations to assess suitability in COBS 9.2.1R to 9.2.3R.

- (2)

Paragraphs (3) and (4) apply in the following situations:

- (a)

where two or more firms are involved in providing both advice on pension transfers, pension conversions and pension opt-outs and advice on investments in relation to the same transaction; and

- (b)

where two or more employees within the same firm are involved in providing both advice on pension transfers, pension conversions and pension opt-outs and advice on investments in relation to the same transaction.

- (a)

- (3)

In such situations, firms should work together (or ensure their employees work together) to:

- (a)

obtain information from the retail client under COBS 9.2.2R(1) that is sufficient to inform both the advice on pension transfers, pension conversions and pension opt-outs and the advice on investments; and

- (b)

obtain information from the retail client under COBS 9.2.2R(2) about the client’s preferences regarding risk taking and their risk profile that covers both the risk in COBS 19.1.6R(4)(b) and the risk in COBS 19.1.6R(4)(c).

- (a)

- (4)

In such situations, the firm(s) providing the advice on investments in relation to the proposed transaction should ensure that (where relevant) the advice takes into account the impact of any loss of safeguarded benefits (or potentially safeguarded benefits) on the retail client’s ability to take on investment risk.

Arranging without making a personal recommendation

7If a firm arranges a pension transfer, pension conversion10 or pension opt-out for a retail client without making a personal recommendation in relation to the pension transfer, pension conversion or pension opt-out10 it must:

-

(1)

make a clear record of the fact that the firm has not given that10personal recommendation to the client;10

-

(1A)

where the pension transfer or pension conversion is within the scope of the requirement in section 48 of the Pension Schemes Act 2015:10

- (a)

not proceed with the arrangements until it has received confirmation, from the firm that gave the advice to the retail client, that the retail client has received a personal recommendation in accordance with the requirements of COBS 19.1 (and that it was not abridged advice); and 10

- (b)

if the client has received a personal recommendation, ask whether or not the recommendation was to transfer or convert; and10

- (c)

retain clear records showing evidence of (a) and (b);10

- (a)

-

(1B)

where the recommendation in (1A) was not to transfer or convert the retail client’s subsisting rights in respect of safeguarded benefits, the firm arranging the pension transfer or pension conversion must: 10

- (a)

warn the retail client that they are acting against advice not to transfer or convert;10

- (b)

ask the retail client whether they understand the consequences of acting against advice;10

- (c)

where the retail client does not understand the consequences of acting against advice, refuse to arrange the pension transfer or conversion and instead refer the retail client back to the firm that advised them not to transfer or convert for an explanation of that advice; and10

- (d)

retain a record of the communications with the retail client that evidence compliance with the requirements in (a) to (c);10

- (a)

-

(2)

retain the records in (1), (1A) and (1B)10 indefinitely.

10Where the advice referred to in COBS 19.1.7CR(1A) was abridged advice, the firm being asked to arrange the transfer or conversion should not ask the advising firm for confirmation of the abridged advice given. The firm is not permitted to arrange the relevant pension transfer or pension conversion where the advice given was abridged advice.

10Where the firm that has given advice to a retail client is asked by a firm arranging a pension transfer or pension conversion that is within the scope of the requirement in section 48 of the Pension Schemes Act 2015 to:

- (a)

provide a confirmation that the retail client has received a personal recommendation in accordance with the requirements of COBS 19.1 (and that it was not abridged advice); and

- (b)

if the client has received a personal recommendation, confirm whether or not the recommendation was to transfer or convert,

the advising firm must provide the requested information to the firm arranging a pension transfer or pension conversion as soon as reasonably practicable.

Suitability reports

If a firm provides a suitability report to a retail client in accordance with COBS 9.4.2AR10 it should include:

7-

(1)

a summary of the advantages and disadvantages of its personal recommendation;

-

(2)

an analysis of the financial implications (if the recommendation is to opt-out); 7

-

(2A)

a summary of the key outcomes from the appropriate pension transfer analysis10 (if the recommendation is to transfer or convert); and7

-

(3)

a summary of any other material information.

If a firm proposes to advise a retail client not to proceed with a9pension opt-out, it should give that advice in writing.

510Prior to finalising the firm’s personal recommendation, a firm seeking evidence that the client can demonstrate their understanding of the risks in accordance with COBS 19.1.1CR(5) must:

- (1)

make a clear record of either:

- (a)

the evidence showing that the client demonstrated that they understood the risks involved in effecting a pension transfer or pension conversion and the steps taken by the firm to obtain that; or

- (b)

if the firm could not obtain evidence that the client could demonstrate that understanding and the firm did not change to a recommendation not to transfer, the steps taken by the firm to obtain the evidence and clear evidence and explanation of how the firm satisfied itself on reasonable grounds that it was still suitable to continue to make the same personal recommendation; and

- (a)

- (2)

retain the records in (1) indefinitely.

The statutory advice requirement

- (1)

9Where a firm has advised a retail client in relation to a pension transfer or pension conversion and the firm is asked to confirm this for the purposes of section 48 of the Pension Schemes Act 2015, then the firm should provide such confirmation as soon as reasonably practicable.

- (2)

9The firm should provide the confirmation regardless of whether it advised the client to proceed with a pension transfer or pension conversion or not.

Triage services

9The table in PERG 12 Annex 1G includes examples of when a firm is and is not advising on conversion or transfer of pension benefits when it has an initial “triage” conversation with a potential customer. The purpose of triage is to give the customer sufficient information about safeguarded benefits and flexible benefits to enable them to make a decision about whether to take advice on conversion or transfer of pension benefits.