SYSC 23 Annex 1 Definition of SMCR firm and different types of SMCR firms

1Part One: Flow diagram and other basic provisions |

|||

1.1 |

R |

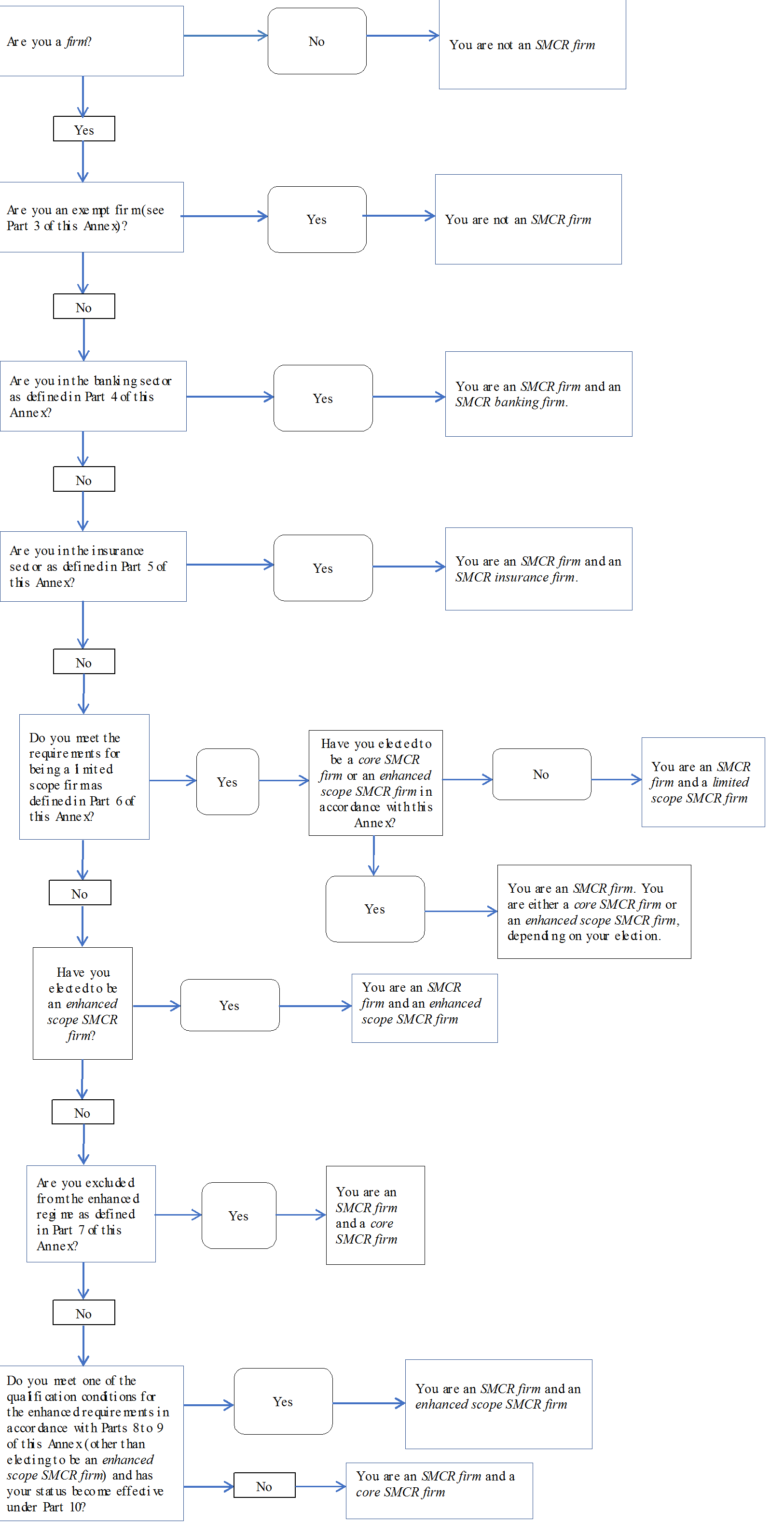

The flow diagram in SYSC 23 Annex 1 1.2R defines: |

|

(1) |

an SMCR firm; and |

||

(2) |

the different categories of SMCR firm. |

||

1.2 |

R |

Flow diagram: Types of SMCR firm |

|

The categorisation in this flow diagram is subject to SYSC 23 Annex 1 2.1R and SYSC 23 Annex 1 6.25R4.

331.3 |

R |

A reference in this Annex to a firm having permission to carry on a particular regulated activity but no other regulated activity includes that firm also having permission for agreeing to carry on a regulated activity in respect of that first regulated activity. |

|

Part Two: Changing category |

|||||||

2.1 |

R |

If a firm is subject to a requirement that it must comply with the rules in the FCA Handbook applicable to one of the categories of SMCR firm set out in this Annex, it is to be treated as falling into that category of SMCR firm for all purposes. |

|||||

32.2 |

G |

(1) |

The FCA may, on a case-by-case basis, require a limited scope SMCR firm or a core SMCR firm to comply with the requirements that apply to an enhanced scope SMCR firm if the FCA considers it appropriate to do so to advance one or more of its operational objectives under the Act. |

||||

(2) |

The most common example of a requirement described in SYSC 23 Annex 1 2.1R is likely to be one of the kind described in (1). |

||||||

(3) |

One effect of SYSC 23 Annex 1 2.1R is that if a firm is moved from the limited scope SMCR firm or core SMCR firm category to the enhanced scope SMCR firm category, the FCA-designated senior management functions that will apply to it are the ones for enhanced scope SMCR firms. |

||||||

32.3 |

G |

(1) |

In practice, it is unlikely that the procedure described in SYSC 23 Annex 1 2.1R will be used to move a firm from a category applicable to PRA-authorised persons to one applicable to FCA-authorised persons or vice versa. |

||||

(2) |

This is because the FCA’s regime for PRA-authorised persons is designed on the basis that the PRA’s regime also applies to those firms while the regime for FCA-authorised persons is designed on the basis that no PRA requirements apply. |

||||||

32.4 |

G |

(1) |

Where a firm becomes or stops being an enhanced scope SMCR firm under the procedure described in SYSC 23 Annex 1 2.1R, the material in Parts 10 and 11 of this Annex about when the change of status becomes effective will not apply. Instead the timing will be dealt with in the variation of permission. |

||||

(2) |

If the variation does not specify the timing of the change, the change is likely to take effect when the variation does. |

||||||

Part Three: Definition of exempt firm |

|||||||

3.1 |

R |

This part defines an exempt firm for the purposes of the flow diagram in Part One of this Annex. |

|||||

3.2 |

R |

An overseas firm is an exempt firm if it: |

|||||

(1) |

does not have; and |

||||||

(2) |

does not have an appointed representative that has; |

||||||

an establishment in the United Kingdom. |

|||||||

3.3 |

R |

An incoming EEA firm that is an EEA pure reinsurer is an exempt firm. |

|||||

33.4 |

R |

An incoming ECA provider acting as such is an exempt firm. |

|||||

33.5 |

R |

A UCITS qualifier is an exempt firm (see section 266 of the Act (Disapplication of rules)). |

|||||

33.6 |

R |

An AIFM qualifier is an exempt firm4. |

|||||

33.7 |

R |

[deleted] |

|||||

33.8 |

G |

As explained in SYSC TP 8.2.1R, certain claims management firms are excluded from being SMCR firms and treated as exempt under this Part. |

|||||

Part Four: Definition of banking sector |

|||||||

4.1 |

R |

A firm is in the banking sector for the purposes of the flow diagram in Part One of this Annex if the firm meets the conditions in SYSC 23 Annex 1 4.2R, SYSC 23 Annex 1 4.4R or SYSC 23 Annex 1 4.6R. |

|||||

4.2 |

R |

A firm is in the banking sector for the purposes of the flow diagram in Part One of this Annex if it is an institution that meets the following conditions: |

|||||

(1) |

it is incorporated in, or formed under the law of any part of, the United Kingdom; |

||||||

(2) |

it is not an institution authorised under the Act to carry on the regulated activity of effecting contracts of insurance or carrying out contracts of insurance; and |

||||||

(3) |

it meets one of the following conditions: |

||||||

(a) |

its Part 4A permission includes accepting deposits; or : |

||||||

(b) |

it meets all the following conditions: |

||||||

(i) |

the institution is an investment firm; |

||||||

(ii) |

its Part 4A permission covers dealing in investments as principal; and |

||||||

(iii) |

when carried on by it, that activity is a PRA-regulated activity. |

||||||

4.3 |

R |

An SMCR banking firm in SYSC 23 Annex 1 4.2R is a UK SMCR banking firm. |

|||||

4.4 |

R |

A firm is also in the banking sector for the purposes of the flow diagram in Part One of this Annex if it is a non-UK institution other than an incoming firm that meets the following conditions: |

|||||

(1) |

it has a branch in the United Kingdom; |

||||||

(2) |

it is not an institution authorised under the Act to carry on the regulated activity of effecting contracts of insurance or carrying out contracts of insurance; and |

||||||

(3) |

it meets one of the following conditions: |

||||||

(a) |

it is a credit institution which has a Part 4A permission that includes accepting deposits; or |

||||||

(b) |

it meets all the following conditions: |

||||||

(i) |

the institution is an investment firm; |

||||||

(ii) |

its Part 4A permission covers dealing in investments as principal; and |

||||||

(iii) |

when carried on by it, that activity is a PRA-regulated activity. |

||||||

4.5 |

R |

An SMCR banking firm in SYSC 23 Annex 1 4.4R is a third-country SMCR banking firm. |

|||||

4.6 |

R |

A firm is also in the banking sector for the purposes of the flow diagram in Part One of this Annex if it is an incoming EEA firm or incoming Treaty firm that meets the following conditions: |

|||||

(1) |

it has a branch in the United Kingdom; |

||||||

(2) |

it is not an institution authorised under the Act to carry on the regulated activity of effecting contracts of insurance or carrying out contracts of insurance; and |

||||||

(3) |

it meets one of the following conditions: |

||||||

(a) |

it is a credit institution which has a permission under Part 4A, Schedule 3 or Schedule 4 of the Act that includes accepting deposits; or |

||||||

(b) |

it meets all the following conditions: |

||||||

(i) |

the institution is an investment firm; |

||||||

(ii) |

it has a permission under Part 4A, Schedule 3 or Schedule 4 of the Act that covers dealing in investments as principal; and |

||||||

(iii) |

when carried on by it, that activity is a PRA-regulated activity. |

||||||

4.7 |

R |

An SMCR banking firm in SYSC 23 Annex 1 4.6R is an EEA SMCR banking firm. |

|||||

Part Five: Definition of insurance sector |

|||||||

5.1 |

R |

A firm is in the insurance sector for the purposes of the flow diagram in Part One of this Annex if the firm is: |

|||||

(1) |

a Solvency II firm (including a large non-directive insurer); or |

||||||

(2) |

|||||||

5.2 |

R |

(1) |

A firm from which the Solvency II rules (as defined by the part of the PRA Rulebook described in this paragraph (1)) are disapplied by chapter 2 of the Solvency II Firms: Transitional Measures part of the PRA Rulebook is in the insurance sector for the purposes of the flow diagram in Part One of this Annex. |

||||

(2) |

A firm defined as a small run-off firm in the Glossary part of the PRA Rulebook is in the insurance sector for the purposes of the flow diagram in Part One of this Annex. |

||||||

3Part Six: Definition of limited scope SMCR firm |

|||||||

Introduction4 |

|||||||

36.1 |

R |

(1) |

This Part sets out the requirements for being a limited scope SMCR firm referred to in the flow diagram in Part One of this Annex. |

||||

(2) |

Where this Part says that a firm is a limited scope SMCR firm, that means that the firm meets those requirements. |

||||||

Opting up4 |

|||||||

36.2 |

G |

Part 12 of this Annex sets out a procedure for a firm that would otherwise have been a limited scope SMCR firm to elect to be a core SMCR firm or an enhanced scope SMCR firm and to reverse that election. |

|||||

Specialised activities4 |

|||||||

36.3 |

R |

(1) |

A firm listed in the table in SYSC 23 Annex 1 6.4R is a limited scope SMCR firm if: |

||||

(a) |

its principal purpose is to carry on activities other than regulated activities; and |

||||||

(b) |

it is not a MiFID investment firm. |

||||||

(2) |

In the case of a firm in SYSC 23 Annex 1 6.4R(5), regulated claims management activities are treated as unregulated activities for the purpose of deciding what the firm’s principal purpose is under (1). |

||||||

36.4 |

R |

Table: List of limited scope SMCR firms referred to in SYSC 23 Annex 1 6.3R |

|||||

(1) |

|||||||

(2) |

|||||||

(3) |

|||||||

(4) |

A wholly owned subsidiary of: |

||||||

(a) a local authority; or |

|||||||

(b) a registered social landlord. |

|||||||

(5) |

A firm that meets the following conditions: |

||||||

(a) it has permission to carry on insurance distribution activity in relation to non-investment insurance contracts; and |

|||||||

(b) it: |

|||||||

(i) either does not have permission to carry on any other regulated activity; or |

|||||||

(ii) has permission to carry on no other regulated activity except one or more of the following: |

|||||||

(A) advising on P2P agreements; or |

|||||||

36.5 |

G |

It will be a matter of fact in each case whether, having regard to all the circumstances, including in particular where the balance of the business lies, a firm’s principal purpose is to carry on activities other than regulated activities. If a firm wishes to rely on SYSC 23 Annex 1 6.3R, it should be in a position to demonstrate that its principal purpose is to carry on activities other than regulated activities. |

|||||

Sole trader4 |

|||||||

36.6 |

R |

A sole trader is a limited scope SMCR firm. |

|||||

Limited permission consumer credit firms4 |

|||||||

36.7 |

R |

A firm whose permission is limited to the carrying on of a relevant credit activity (as defined in paragraph 2G of Schedule 6 to the Act) (a limited permission) is a limited scope SMCR firm, excluding a firm in SYSC 23 Annex 1 6.8R. |

|||||

36.8 |

R |

A not-for-profit debt advice body is a limited scope SMCR firm. |

|||||

Authorised professional firms4 |

|||||||

36.9 |

R |

An authorised professional firm whose only regulated activities are non-mainstream regulated activities is a limited scope SMCR firm. |

|||||

Internally managed AIFs4 |

|||||||

36.10 |

R |

A firm is a limited scope SMCR firm if it meets the following conditions: |

|||||

(1) |

it is an internally managed AIF; |

||||||

(2) |

it is a body corporate; and |

||||||

(3) |

it is not a collective investment scheme. |

||||||

Claims management4 |

|||||||

36.11 |

R |

(1) |

A firm is a limited scope SMCR firm if it meets the following conditions: |

||||

(a) |

it has permission to carry on regulated claims management activities; and |

||||||

(b) |

it: |

||||||

(i) |

either does not have permission to carry on any other regulated activity; or |

||||||

(ii) |

has permission to carry on no other regulated activity except a relevant credit activity. |

||||||

(2) |

A firm in SYSC 23 Annex 1 6.7R or SYSC 23 Annex 1 6.8R does not fall within this rule. |

||||||

Benchmark firms: Waiver applying limited scope status4 |

|||||||

46.12 |

R |

A firm is a limited scope SMCR firm (and a limited scope SMCR benchmark firm) if: |

|||||

(1) |

it is subject to a waiver that applies this rule to the firm; and |

||||||

(2) |

it meets the conditions in SYSC 23 Annex 1 6.13R. |

||||||

46.13 |

R |

(1) |

The conditions referred to in SYSC 23 Annex 1 6.12R(2) are that the firm: |

||||

(a) |

is capable of being a limited scope SMCR firm under the flow diagram in SYSC 23 Annex 1 1.2R (Flow diagram: Types of SMCR firm); |

||||||

(b) |

has permission to carry on the regulated activity of administering a benchmark but no other regulated activity (a pure benchmark SMCR firm); and |

||||||

(c) |

is an FCA-authorised person. |

||||||

(2) |

A firm that meets the conditions in this rule is referred to in this Annex as a “potential benchmark waiver firm”. |

||||||

46.14 |

G |

(1) |

If, after the waiver in SYSC 23 Annex 1 6.12R(1) comes into force, a firm ceases to be a potential benchmark waiver firm it immediately ceases to be: |

||||

(a) |

|||||||

(b) |

a limited scope SMCR firm (unless it qualifies as one for another reason). |

||||||

(2) |

(1) applies even if the firm subsequently becomes a potential benchmark waiver firm again. |

||||||

(3) |

If (2) applies, it may become a limited scope SMCR benchmark firm again if it applies for and obtains a new waiver. |

||||||

4Benchmark firms: When the waiver is likely to be available |

|||||||

(1) |

The FCA considers that treating a potential benchmark waiver firm (as defined in SYSC 23 Annex 1 6.13R(2)) as a core SMCR firm may be unduly burdensome as contemplated by section 138A(4)(a) of the Act (Modification or waiver of rules). |

||||||

(2) |

The FCA considers that deciding whether this is the case involves balancing the factors in (3) and (4). |

||||||

(3) |

The directors of a potential benchmark waiver firm who would require approval for performing one of the FCA governing functions if it was a core SMCR firm may spend very little of their time managing the firm’s regulated activities. In a big firm they may also be distant from those activities. It may therefore be more proportionate to require approval for someone who is closer to the day-to-day management of the firm’s regulated activities. |

||||||

(4) |

On the other hand, applying the Act and the FCA’s requirements directly to a firm’s most senior management will make it more likely that they will take steps and put in place systems that will increase the likelihood that the firm’s staff will meet the requirements of the senior managers and certification regime and that the values represented by those requirements will be absorbed into the firm’s culture. It also helps to ensure that the firm’s leaders have sufficient knowledge of, and skills in, the firm’s regulated activities. |

||||||

(5) |

The approach in SYSC 23 Annex 1 6.16G is designed to weigh the factors in (3) and (4) against each other. |

||||||

46.16 |

G |

(1) |

SYSC 23 Annex 1 6.16G summarises the approach the FCA anticipates it will take in deciding whether to grant the waiver. SYSC 23 Annex 1 6.17G to SYSC 23 Annex 1 6.22G then give more detail. |

||||

(2) |

Subject to (3), the FCA considers that a potential benchmark waiver firm (as defined in SYSC 23 Annex 1 6.13R(2)) is likely to meet the criteria for the granting of a waiver in section 138A(4)(a) of the Act (Modification or waiver of rules) if regulated activities form a small part of its activities, measured in the way described in SYSC 23 Annex 1 6.17G. |

||||||

(3) |

The FCA considers that a potential benchmark waiver firm meeting the conditions in (2) is nevertheless unlikely to meet the criteria for the granting of a waiver in section 138A(4) of the Act if: |

||||||

(a) |

any of the benchmarks it administers are important; or |

||||||

(b) |

the firm or the person who would be performing the limited scope function would not meet the requirements of MAR 8.5.2R (Responsibility for benchmark activities: regulated benchmark administrators). |

||||||

(4) |

In particular, under (3)(b): |

||||||

(a) |

the person who would be performing the limited scope function should be sufficiently senior (see MAR 8.5.3AG); and |

||||||

(b) |

the responsibilities in MAR 8.5.2R should not be split between several people (see MAR 8.5.3G). |

||||||

(5) |

SYSC 23 Annex 1 6.18G to SYSC 23 Annex 1 6.20G describe what important means in (3)(a). |

||||||

(6) |

SYSC 23 Annex 1 6.22G gives more detail about (3)(b). |

||||||

(7) |

|||||||

46.17 |

G |

(1) |

SYSC 23 Annex 1 6.17G describes how the FCA anticipates that it would decide whether regulated activities form a small part of a firm’s activities for the purpose of SYSC 23 Annex 1 6.16G(2). |

||||

(2) |

The FCA anticipates that it would consider that: |

||||||

(a) |

a firm would meet the criterion in (1) if revenue from regulated activities represents less than 20% of its overall revenue; and |

||||||

(b) |

a firm would not meet the criterion in (1) if revenue from regulated activities were 20% or more. |

||||||

(3) |

The FCA anticipates that it would measure those figures over a reasonable period and not just a single accounting period. |

||||||

(4) |

The FCA anticipates that it would measure revenue from regulated activities and overall revenue in the way described in SUP 15.17.5R to SUP 15.17.7R (Obligation to make calculations). |

||||||

(5) |

The FCA anticipates that it would adjust the calculation if there were good reason to think that past revenue is unlikely to be representative of the future. For instance: |

||||||

(a) |

the firm’s past revenue may be distorted by extraordinary items; or |

||||||

(b) |

the firm may recently have carried out a major reorganisation of its business involving, for example, the disposal of all its activities other than benchmark activities or the acquisition of a business carrying out activities other than benchmark activities. |

||||||

46.18 |

G |

The FCA anticipates that, in deciding whether a benchmark is important for the purposes in SYSC 23 Annex 1 6.16G, it will take into account whether there could be a significant and adverse impact on the United Kingdom’s economy or financial system if the benchmark: |

|||||

(1) |

stops being provided; or |

||||||

(2) |

is provided in a way that significantly breaches or falls short of the requirements and standards of the benchmarks regulation. |

||||||

46.19 |

G |

The FCA considers that a firm’s benchmark is likely to be important for the purposes in SYSC 23 Annex 1 6.16G(3) and to meet the criteria in SYSC 23 Annex 1 6.18G if the benchmark is recognised as critical under the benchmarks regulation. |

|||||

46.20 |

G |

In making the assessment of the importance of a benchmark that is not recognised as critical as described in SYSC 23 Annex 1 6.19G, the FCA anticipates that it will take into account factors that include the following: |

|||||

(1) |

whether the benchmark has no or very few appropriate market-led substitutes; and |

||||||

(2) |

whether the benchmark is used extensively in particular markets or sectors. |

||||||

46.21 |

G |

(1) |

One reason for taking into account the importance of a benchmark is that if it is important, the factors in SYSC 23 Annex 1 6.15G(4) outweigh the factors in SYSC 23 Annex 1 6.15G(3). |

||||

(2) |

Another reason is that, under section 138A(4)(b) of the Act (Modification or waiver of rules), the FCA may not grant a waiver if doing so would adversely affect the advancement of any of its operational objectives. Granting the waiver where a benchmark is important is likely to be inconsistent with section 138A(4)(b) because: |

||||||

(a) |

the occurrence of the situation in SYSC 23 Annex 1 6.18G(1) or (2) is likely in particular to prejudice the integrity operational objective; and |

||||||

(b) |

for the reasons in SYSC 23 Annex 1 6.15G(4), the FCA considers that applying the regime for core SMCR firms to benchmark firms will reduce the risk of that happening. |

||||||

46.22 |

G |

The FCA anticipates that if a firm has a complicated management structure, that may mean that the firm does not meet the conditions in SYSC 23 Annex 1 6.16G(3)(b). In particular this may be the case if: |

|||||

(1) |

there are several managers involved in managing the firm’s regulated activities who have different reporting lines; or |

||||||

(2) |

the person managing the firm’s regulated activities has different reporting lines for different aspects of the role that give them different levels of autonomy. |

||||||

4Benchmark firms: Ceasing to meet waiver criteria |

|||||||

46.23 |

G |

If a limited scope SMCR benchmark firm ceases to meet the criterion in SYSC 23 Annex 1 6.17G, it is likely to be inappropriate for the waiver to continue. The mechanism for ensuring that this is the case might include one or more of the following: |

|||||

(1) |

building those criteria into the waiver; |

||||||

(2) |

revocation of the waiver; or |

||||||

(3) |

granting the waiver subject to a time limit and re-examining the criteria if the firm applies for a renewal. |

||||||

46.24 |

G |

The FCA anticipates that the mechanisms in SYSC 23 Annex 1 6.23G will generally provide for a period of time between the firm ceasing to meet the criterion in SYSC 23 Annex 1 6.17G and the firm ceasing to be a limited scope SMCR firm. |

|||||

4Benchmark firms: Opting to be a core or enhanced scope firm |

|||||||

46.25 |

R |

(1) |

A limited scope SMCR benchmark firm may opt to be an enhanced scope SMCR firm in accordance with this Annex. |

||||

(2) |

A limited scope SMCR benchmark firm may not opt to be a core SMCR firm under this Annex. |

||||||

46.26 |

G |

If a limited scope SMCR benchmark firm opts to be an enhanced scope SMCR firm and it subsequently revokes that election after it comes into effect, the firm will become a core SMCR firm. If it wants to be a limited scope SMCR benchmark firm again it will need to apply for a new waiver. |

|||||

46.27 |

G |

A limited scope SMCR benchmark firm that wishes to become a core SMCR firm again should request the FCA to revoke the waiver in SYSC 23 Annex 1 6.12R. |

|||||

3Part Seven: Exclusion from enhanced regime |

|||||||

37.1 |

R |

This Part sets out which firms are excluded from the enhanced regime for the purposes of the flow diagram in Part One of this Annex. |

|||||

37.2 |

R |

An overseas SMCR firm is excluded from the enhanced regime. |

|||||

37.3 |

R |

A firm is excluded from the enhanced regime if its permission only covers being the full-scope UK AIFM of: |

|||||

(1) |

an unauthorised AIF; or |

||||||

(2) |

an authorised AIF only marketed to investors that are professional clients. |

||||||

37.4 |

R |

A firm is excluded from the enhanced regime if: |

|||||

(1) |

it is exempt from MiFID under article 2(1)(j); and |

||||||

(2) |

its only permission is bidding in emissions auctions. |

||||||

3Part Eight: Financial qualification condition for being an enhanced scope SMCR firm |

|||||||

3The financial qualification tests |

|||||||

38.1 |

R |

A firm meets a qualification condition for the purposes of identifying an enhanced scope SMCR firm under the flow diagram in Part One of this Annex if it meets one of the criteria set out in column (1) of the table in SYSC 23 Annex 1 8.2R. |

|||||

38.2 |

R |

Table: Financial qualification conditions |

|||||

3(1) Qualification condition |

(2) How to do the calculation and corresponding reporting requirement |

(3) Comments |

|||||

Part One: Point in time measurements |

|||||||

(1) The average amount of the firm’s assets under management (calculated as a three-year rolling average) is £50 billion or more |

Assets under management are calculated in accordance with the method that must be used to calculate the amount to be recorded in data element 1A (Total funds under management) in data item FSA038 (Volumes and Type of Business) |

SYSC 23 Annex 1 8.8R(2) and SYSC 23 Annex 1 8.11R apply to this calculation. |

|||||

(2) The firm currently has 10,000 or more outstanding regulated mortgages |

A firm’s outstanding regulated mortgages are calculated as follows: (a) calculate the amount that must be recorded in row E4.5 (Total) in the box under the successive headings and sub-headings “Regulated Loans”, “Balances outstanding” and “Number” in the MLAR; (b) calculate the amount that must be recorded in row G1.1(d) (total) under the successive headings and sub-headings “As PRINCIPAL administrator” and “Regulated loans” in the MLAR; and (c) add those amounts together. |

||||||

Part Two: Revenue measurements |

|||||||

(3) The average amount of the firm’s total intermediary regulated business revenue (calculated as a three-year rolling average) is £35 million per annum or more |

Total intermediary regulated business revenue is calculated in accordance with the method that must be used to calculate the amount to be recorded in data element 4E (Total regulated business revenue) in Section B (Profit and Loss account) of the RMAR |

SYSC 23 Annex 1 8.8R(3) applies to this calculation. SYSC 23 Annex 1 8.18R applies this condition to firms to which the reporting requirement in column (2) does not apply in the cases specified in that rule. |

|||||

(4) The average amount of the firm’s annual revenue generated by regulated consumer credit lending (calculated as a three-year rolling average) is £100 million or more |

Annual revenue generated by regulated consumer credit lending is calculated as follows: (a) calculate each amount that must be recorded in column B (Revenue) for the rows headed “Lending” in data item CCR002 (Consumer Credit data: Volumes); and (b) add those amounts together. |

SYSC 23 Annex 1 8.8R(3) applies to this calculation. |

|||||

Note 1: Where Parts 8 to 11 of SYSC 23 Annex 1 refer to a calculation period they refer to the annual period in column (1). |

|||||||

Note 2: Where Parts 8 to 11 of SYSC 23 Annex 1 refer to an averaging period they refer to the three-year period in column (1). |

|||||||

Note 3: Where Parts 8 to 11 of SYSC 23 Annex 1 refer to a reporting period they refer to the period for which reports in column (2) are prepared. |

|||||||

Note 4: Where Parts 8 to 11 of SYSC 23 Annex 1 refer to a calculation date they refer to the date as of which the calculations in column (2) of this table are made. |

|||||||

38.3 |

G |

(1) |

Column (2) of the table in SYSC 23 Annex 1 8.2R refers to the FCA Handbook versions of the relevant data items. |

||||

(2) |

The boxes referred to in row (2) (outstanding regulated mortgages) correspond to the online version of the MLAR as follows: |

||||||

(a) |

paragraph (a) corresponds to data item c3; and |

||||||

(b) |

paragraph (b) corresponds to data item G1.1 c1 (d). |

||||||

Qualification conditions only apply if reporting requirements apply |

|||||||

38.4 |

R |

Subject to SYSC 23 Annex 1 8.18R, a qualification condition in column (1) of the table in SYSC 23 Annex 1 8.2R only applies to a firm if the corresponding reporting requirement referred to in column (2) of the table currently applies to the firm. |

|||||

General calculation principles |

|||||||

38.5 |

R |

If the applicable financial reporting requirements in column (2) of the table in SYSC 23 Annex 1 8.2R have changed during the relevant period, the calculations must be made in accordance with whatever requirements applied for the applicable period. |

|||||

38.6 |

R |

The calculations are made on a solo basis. |

|||||

38.7 |

R |

(1) |

The calculation periods, averaging periods and dates in column (1) of the table in SYSC 23 Annex 1 8.2R are defined so as to be consistent with the financial reporting periods and calculation dates used for the corresponding data item in column (2) of that table. The rest of this rule gives examples of this principle. |

||||

(2) |

If a calculation in column (1) of the table in SYSC 23 Annex 1 8.2R is based on per annum or annual revenue and the reporting period in column (2) is based on the firm’s accounting period: |

||||||

(a) |

the calculation periods in column (1) are also based on the firm’s accounting period; and |

||||||

(b) |

the averaging period in column (1) is made up of the applicable number of accounting periods. |

||||||

(3) |

If a calculation in column (1) of the table in SYSC 23 Annex 1 8.2R is based on per annum or annual revenue and the reporting period in column (2) is based on a calendar year: |

||||||

(a) |

the calculation periods in column (1) are also based on a calendar year; and |

||||||

(b) |

the averaging period in column (1) is made up of the applicable number of calendar years. |

||||||

(4) |

Where row (2) of column (1) of the table in SYSC 23 Annex 1 8.2R refers to a firm’s current financial figures it refers to the figures as at the calculation date for its most recent reporting period in column (2). |

||||||

(5) |

A firm’s most recent reporting period is the one for the data item whose required submission date has passed most recently. |

||||||

Averaging periods |

|||||||

38.8 |

R |

(1) |

This rule deals with the establishment of a firm’s averaging periods. |

||||

(2) |

When the table in SYSC 23 Annex 1 8.2R specifies that this paragraph (2) applies: |

||||||

(a) |

each averaging period ends on the calculation date for a reporting period; and |

||||||

(b) |

there is an averaging period that ends on each such day. |

||||||

(3) |

When the table in SYSC 23 Annex 1 8.2R specifies that this paragraph (3) applies: |

||||||

(a) |

each averaging period ends on the last day of a year; and |

||||||

(b) |

there is an averaging period that ends on each such day. |

||||||

(4) |

The term ‘year’ in (3) is defined in accordance with SYSC 23 Annex 1 8.7R. |

||||||

38.9 |

G |

(1) |

SYSC 23 Annex 1 8.8R(2) provides for a firm’s status to be tested every six months if the relevant data item is reported in six-month intervals and to be tested yearly if the relevant data item is reported yearly. |

||||

(2) |

SYSC 23 Annex 1 8.8R(3) provides for a firm’s status to be tested once a year even if the relevant data item is reported in six-month intervals. |

||||||

Requirements where the firm reports more than once a year |

|||||||

38.10 |

R |

(1) |

This rule applies to calculations in Part Two of the table in SYSC 23 Annex 1 8.2R. |

||||

(2) |

If: |

||||||

(a) |

the firm reports the relevant data items more than once a year; and |

||||||

(b) |

each successive report covers the whole year to date; |

||||||

the calculations in the table are only based on the data item that covers the full year. |

|||||||

(3) |

The term year in (2) is defined in accordance with SYSC 23 Annex 1 8.7R. |

||||||

Requirements for calculating average amounts in certain cases |

|||||||

38.11 |

R |

When the table in SYSC 23 Annex 1 8.2R specifies that this rule applies, the calculation of the average involves calculating the relevant amount for each reporting period relating to the averaging period, summing those amounts and dividing the result by the applicable number of reporting periods. |

|||||

Adjustments where reporting periods cover irregular periods |

|||||||

38.12 |

R |

(1) |

This rule applies where: |

||||

(a) |

the calculation is under Part Two of the table in SYSC 23 Annex 1 8.2R; |

||||||

(b) |

the reporting period in column (2) is based on the firm’s accounting period; |

||||||

(c) |

any of the firm’s accounting periods in the applicable averaging period is not twelve months; and |

||||||

(d) |

as a result the averaging period would not be a whole number of calendar years. |

||||||

(2) |

Where this rule applies, the firm must adjust the minimum qualification amount in column (1) proportionately. |

||||||

38.13 |

G |

The main example of when SYSC 23 Annex 1 8.12R may apply is where a firm changes its accounting reference date. |

|||||

Short reporting periods |

|||||||

38.14 |

G |

(1) |

The financial reporting period may be shorter than the corresponding calculation period. |

||||

(2) |

For example, the calculation period may be based on annual revenue but the firm may have to prepare the corresponding data item in column (2) of the table in SYSC 23 Annex 1 8.2R for revenue arising in six-month periods. |

||||||

(3) |

If SYSC 23 Annex 1 8.10R applies this does not matter as the calculation is based on the figures for the full year. |

||||||

(4) |

If SYSC 23 Annex 1 8.10R does not apply, in the example in (2): |

||||||

(a) |

the calculation of the firm’s most recent annual revenue in column (1) is based on the most recently ended six-month period and the six-month period before that; and |

||||||

(b) |

each year within the three-year averaging period is based on two six-month periods. |

||||||

Effect of reporting requirements not applying for full period |

|||||||

38.15 |

R |

Subject to SYSC 23 Annex 1 8.4R, if the reporting requirement referred to in column (2) of the table in SYSC 23 Annex 1 8.2R did not apply to the firm for the whole of its most recent averaging period as defined in SYSC 23 Annex 1 8.2R, the averaging period is shortened to cover the period for which those requirements did apply. |

|||||

38.16 |

G |

Reasons why SYSC 23 Annex 1 8.15R may apply to a firm include the following: |

|||||

(1) |

the firm has only recently been authorised; |

||||||

(2) |

the firm’s Part 4A permission has only recently been varied to include the relevant regulated activities; |

||||||

(3) |

the firm has only recently become subject to the relevant reporting requirements; or |

||||||

(4) |

the reporting requirement did not exist for the full period (see SYSC TP 7.7.6G for an example). |

||||||

38.17 |

G |

(1) |

This paragraph gives an example of how SYSC 23 Annex 1 8.15R works. |

||||

(2) |

In this example: |

||||||

(a) |

the relevant qualification condition is one of those in Part Two of the table in SYSC 23 Annex 1 8.2R; |

||||||

(b) |

the reporting requirement is based on a firm’s accounting year and reports are due every six months; |

||||||

(c) |

the firm’s accounting year ends on 31 December; |

||||||

(d) |

the firm is authorised in February. |

||||||

(2) |

The firm will not meet the qualification condition before the end of Year One, however large its business is in the period from February to June. This is because the calculations are based on calculation periods of a year and the year is not over yet. |

||||||

(3) |

Following the end of Year One, the assessment of whether the firm meets the qualification condition is based on the figures for Year One. There is no adjustment to take account of the fact that the firm was only authorised part of the way through that period. |

||||||

(4) |

After the end of Year Two, the averaging period is two years and the figures are taken from the part of Year One during which it was authorised and from Year Two. |

||||||

(5) |

The figures for the next averaging period are taken from the part of Year One during which it was authorised and from Years Two and Three. |

||||||

(6) |

If the firm in this example is authorised in September, the assessment of whether the firm meets the qualification condition for Year One is based on the figures for the part of Year One for which it is authorised, as it is in (3). However, in contrast to (2), that means that the assessment is made in respect of its first few months of authorisation. |

||||||

(7) |

In this paragraph: |

||||||

(a) |

the firm being authorised means the firm being authorised or the relevant regulated activities being included in its permission so that the relevant reporting requirement applies; |

||||||

(b) |

the accounting year in which this occurs is referred to as Year One; and |

||||||

(c) |

subsequent accounting years are referred to accordingly. |

||||||

Special requirements for calculating intermediary regulated business revenue |

|||||||

38.18 |

R |

The qualification condition in row (3) of the table in SYSC 23 Annex 1 8.2R may also apply to a firm that meets the following conditions, even though the financial reporting requirement referred to in that row does not apply to it: |

|||||

(1) |

it falls into any of the following categories: |

||||||

(a) |

its permission includes an insurance distribution activity in relation to non-investment insurance contracts; |

||||||

(b) |

its permission includes a home finance mediation activity; |

||||||

(c) |

it is a retail investment firm; |

||||||

(d) |

it is a personal investment firm; |

||||||

(e) |

(subject to SYSC 23 Annex 1 8.19R) its permission includes advising on P2P agreements; or |

||||||

(f) |

(subject to SYSC 23 Annex 1 8.20R) its permission includes designated investment business or it carries out designated investment business; and |

||||||

(2) |

it is not required to complete Section B of the RMAR. |

||||||

38.19 |

R |

A firm is excluded from SYSC 23 Annex 1 8.18R(1)(e) if its permission, so far as it relates to the activity in SYSC 23 Annex 1 8.18R(1)(e), is limited to activities carried on exclusively with or for professional clients. |

|||||

38.20 |

R |

A firm is excluded from SYSC 23 Annex 1 8.18R(1)(f) if its permission, so far as it relates to the activity in SYSC 23 Annex 1 8.18R(1)(f), is limited and subject to requirements in a way that means it may only carry on those activities exclusively with or for professional clients or eligible counterparties. |

|||||

38.21 |

R |

(1) |

This rule deals with how the qualification condition in row (3) of the table in SYSC 23 Annex 1 8.2R applies to a firm in SYSC 23 Annex 1 8.18R. |

||||

(2) |

The calculation is made in accordance with the requirements for Section B (Profit and Loss account) of the RMAR and otherwise as described in column (2) of row (3) of the table in SYSC 23 Annex 1 8.2R. |

||||||

(3) |

The reporting period for the purposes of this Annex is an annual period ending on the firm’s accounting reference date. |

||||||

(4) |

For the purpose of applying this Annex to a firm in SYSC 23 Annex 1 8.18R, a reference in this Annex to: |

||||||

(a) |

the due submission date for a data item is treated as being to the reporting date defined in SUP 15.15.9R; |

||||||

(b) |

a firm’s most recent reporting period is the period in (3) whose reporting date (as defined in (4)(a)) has occurred most recently; and |

||||||

(c) |

being subject to a reporting requirement is treated as a reference to meeting the conditions in SYSC 23 Annex 1 8.18R. |

||||||

38.22 |

G |

(1) |

There is only one qualification condition in row (3) of the table in SYSC 23 Annex 1 8.2R. |

||||

(2) |

Therefore if a firm ceases to be in SYSC 23 Annex 1 8.18R because it begins to report using the RMAR, SYSC 23 Annex 1 8.4R does not apply and the firm will continue to meet the qualification condition as long as its income remains at the necessary level. |

||||||

(3) |

The same applies if the firm moves from reporting using the RMAR to being a firm within SYSC 23 Annex 1 8.18R. |

||||||

(4) |

If a firm makes a change of the kind in (2) or (3), the figures for the averaging periods during which this occurs will be made up of figures taken from its RMAR and ones calculated under SUP 15.15. SYSC 23 Annex 1 8.15R does not apply. |

||||||

(5) |

If there is a gap between being subject to SYSC 23 Annex 1 8.18R and reporting using the RMAR, SYSC 23 Annex 1 11.8R may mean that the firm never stops being an enhanced scope SMCR firm. |

||||||

38.22 |

G |

SUP 15.15 requires a firm within SYSC 23 Annex 1 8.18R regularly to calculate whether it meets the qualification condition in row (3) of the table in SYSC 23 Annex 1 8.2R and, in certain circumstances, to notify the FCA of the results. |

|||||

Part Nine: Other qualification conditions for being an enhanced scope SMCR firm |

|||||||

39.1 |

R |

A firm meets a qualification condition for the purposes of identifying an enhanced scope SMCR firm under the flow diagram in Part One of this Annex if it meets one of the following criteria: |

|||||

(1) |

the firm is a significant IFPRU firm; |

||||||

(2) |

the firm is a CASS large firm; or |

||||||

(3) |

the firm notifies the FCA in accordance with Part 12 of this Annex that it intends to become an enhanced scope SMCR firm. |

||||||

39.2 |

G |

If a firm is subject to a requirement that it must comply with the rules in the FCA Handbook applicable to one of the categories of firm in SYSC 23 Annex 1 9.1R(1) or SYSC 23 Annex 1 9.1R(2) it is to be treated as falling into that category of firm for the purpose of this Annex as well. |

|||||

Part Ten: When a firm becomes an enhanced scope SMCR firm |

|||||||

General rule |

|||||||

310.1 |

R |

(1) |

A firm must comply with the requirements for enhanced scope SMCR firms (and becomes an enhanced scope SMCR firm) from the date specified in this rule. |

||||

(2) |

If a firm: |

||||||

(a) |

was not an enhanced scope SMCR firm; and |

||||||

(b) |

then meets one of the qualification conditions in Part 8 or Part 9 of this Annex; |

||||||

the date is twelve months after it first meets the first qualification condition that it met. |

|||||||

(3) |

Where the first qualification condition it meets is the one in SYSC 23 Annex 1 9.1R(3), the date is three months after the FCA receives the notice in SYSC 23 Annex 1 9.1R(3). |

||||||

(4) |

(3) also applies if: |

||||||

(a) |

it meets the qualification condition in SYSC 23 Annex 1 9.1R(3) after it meets another qualification condition; and |

||||||

(b) |

the result of applying (3) would be that the firm would become an enhanced scope SMCR firm sooner. |

||||||

(5) |

This rule is subject to SYSC 23 Annex 1 11.8R. |

||||||

Meeting the financial thresholds in Part 8 |

|||||||

310.2 |

R |

(1) |

Subject to (4), a firm first meets one of the qualification conditions in Part 8 of this Annex (financial qualification conditions) on the due date for submission of the relevant data item (see (2) and (3) for the meaning of relevant data item). |

||||

(2) |

Except where (3) applies, the relevant data item is the data item for the final reporting period applicable to the averaging period for which the firm first meets the condition in column (1) of the applicable row in the table in SYSC 23 Annex 1 8.2R. |

||||||

(3) |

Where the qualification condition is the one in row (2) of the table in SYSC 23 Annex 1 8.2R, the relevant data item is the one for the reporting period for which the firm first meets the condition in column (1) of that row. |

||||||

(4) |

In the case of a firm in SYSC 23 Annex 1 8.18R, the firm meets the qualification condition in row (3) of the table in SYSC 23 Annex 1 8.2R on the reporting date for the final reporting period applicable to the averaging period for which the firm first meets the condition in column (1) of that row. |

||||||

Meeting the qualification conditions in Part 9 |

|||||||

310.3 |

R |

A firm meets one of the qualification conditions in Part 9 of this annex (other qualification conditions) on the date when: |

|||||

(1) |

the status in SYSC 23 Annex 1 9.1R(1) or SYSC 23 Annex 1 9.1R(2) becomes effective; or (as the case may be) |

||||||

(2) |

the FCA receives the notice in SYSC 23 Annex 1 9.1R(3). |

||||||

310.4 |

G |

SYSC 23 Annex 1 10.1R and SYSC 23 Annex 1 10.3R mean that a firm becomes an enhanced scope SMCR firm under Part 9 of this Annex on the date in column (2) of the table in SYSC 23 Annex 1 10.5G. |

|||||

310.5 |

G |

Table: Date firm becomes an enhanced scope firm |

|||||

Qualification condition |

Date firm becomes an enhanced scope SMCR firm |

||||||

The firm is a significant IFPRU firm |

It becomes an enhanced scope SMCR firm one year and three months after the date in IFPRU 1.2.3R (the three-month period in IFPRU 1.2.6R(2) plus the one year in this Part). |

||||||

The firm is a CASS large firm This includes a firm that has elected to be treated as a CASS large firm |

If the firm notifies the FCA in accordance with CASS 1A.2.9R(1) or CASS 1A.2.9R(2), it becomes an enhanced scope SMCR firm one year following the 1 February following the notification under CASS. If the firm notifies the FCA in accordance with CASS 1A.2.9R(3), it becomes an enhanced scope SMCR firm one year after the day it begins to hold client money or safe custody assets. If the firm makes an election under CASS 1A.2.5R(1), it becomes an enhanced scope SMCR firm one year after the day the notification made under CASS 1A.2.5R(2)(a) states that the election is intended to take effect. |

||||||

The firm opts to be an enhanced scope SMCR firm by notifying the FCA using Form O |

It becomes an enhanced scope SMCR firm three months after the FCA receives the notice. |

||||||

310.6 |

G |

(1) |

The purpose of the one year or three-month period between meeting the conditions for being an enhanced scope SMCR firm and the firm becoming subject to the requirements for such firms is to allow it to make preparations to comply with the new requirements. |

||||

(2) |

For example, a core SMCR firm opting up to be an enhanced scope SMCR firm should use this period to apply for approval for its personnel to perform the new designated senior management functions that will apply because it has become an enhanced scope SMCR firm. |

||||||

310.7 |

G |

(1) |

A firm retains its old status during the one-year or three-month period described in this Part. |

||||

(2) |

For example, a core SMCR firm that meets one of the qualification conditions for being an enhanced scope SMCR firm in SYSC 23 Annex 1 9.1R(1) or SYSC 23 Annex 1 9.1R(2) will remain as a core SMCR firm for one year after it meets the qualification condition. |

||||||

Part Eleven: When a firm stops being an enhanced scope SMCR firm |

|||||||

General rule |

|||||||

311.1 |

R |

A firm that: |

|||||

(1) |

was an enhanced scope SMCR firm; and |

||||||

(2) |

then meets none of the qualification conditions in this Annex; |

||||||

ceases to be subject to the requirements for enhanced scope SMCR firms (and ceases to an enhanced scope SMCR firm) one year after it ceases to meet the last qualification condition that it met. |

|||||||

Ceasing to meet the financial thresholds in Part 8 |

|||||||

311.2 |

R |

A firm ceases to meet one of the qualification conditions in Part 8 of this Annex (financial qualification conditions) on whichever of the following is applicable: |

|||||

(1) |

the due date for submission of the data item for the final reporting period applicable to the averaging period for which the firm first ceases to meet the condition in column (1) of the applicable row in the table in SYSC 23 Annex 1 8.2R; or |

||||||

(2) |

(where the qualification condition is the one in row (2) of the table in SYSC 23 Annex 1 8.2R) the due date for submission of the data item for the reporting period for which the firm first ceases to meet the condition in column (1) of that row; or |

||||||

(3) |

(in the case of a firm in SYSC 23 Annex 1 8.18R) the reporting date for the final reporting period applicable to the averaging period for which the firm first ceases to meet the condition in column (1) of that row; or |

||||||

(4) |

the date the relevant reporting requirement ceases to apply as referred to in SYSC 23 Annex 1 8.4R. |

||||||

Ceasing to meet the qualification conditions in Part 9 |

|||||||

311.3 |

R |

A firm ceases to meet one of the qualification conditions in SYSC 23 Annex 1 9.1R(1) or SYSC 23 Annex 1 9.1R(2) (other qualification conditions) on the date that the status in SYSC 23 Annex 1 9.1R ceases to apply. |

|||||

311.4 |

R |

(1) |

This rule deals with a firm that notifies the FCA under Part 12 of this Annex that it is cancelling its election to be an enhanced scope SMCR firm under SYSC 23 Annex 1 9.1R(3). |

||||

(2) |

The firm ceases to meet the qualification condition under SYSC 23 Annex 1 9.1R(3) on the date the FCA receives the notice. |

||||||

Only meeting qualification conditions for a short time |

|||||||

311.5 |

R |

(1) |

This rule deals with a case in which a firm ceases to meet a qualification condition in Part 8 or Part 9 of this Annex while the one-year period in Part 10 of this Annex resulting from meeting that qualification condition is still running. |

||||

(2) |

The result is that the firm does not become an enhanced scope SMCR firm. The one-year period no longer runs. |

||||||

311.6 |

G |

If, after the firm ceases to meet a qualification condition as described in SYSC 23 Annex 1 11.5R, it later meets the same qualification condition or another qualification condition in Part 8 or Part 9 of this Annex, a new one-year period or, as applicable, three-month period, under Part 10 of this Annex begins. This applies even if it meets that qualification condition during the one-year period referred to in SYSC 23 Annex 1 11.5R. |

|||||

311.7 |

G |

(1) |

SYSC 23 Annex 1 12.13R allows a firm to withdraw an election to be an enhanced scope SMCR firm before it takes effect. |

||||

(2) |

The result is that the firm does not become an enhanced scope SMCR firm and the three-month period in in SYSC 23 Annex 1 11.1R does not apply. |

||||||

Only ceasing to meet qualification conditions for a short time |

|||||||

311.8 |

R |

If: |

|||||

(1) |

the one-year period in SYSC 23 Annex 1 11.1R is still running; and |

||||||

(2) |

the firm again meets a qualification condition in Part Eight or Nine of this Annex; |

||||||

then (subject to SYSC 23 Annex 1 12.5R): |

|||||||

(3) |

the firm remains an enhanced scope SMCR firm; and |

||||||

(4) |

the one-year period in Part Ten of this Annex does not apply. |

||||||

311.9 |

G |

SYSC 23 Annex 1 12.5R allows a firm to opt to remain as an enhanced scope SMCR firm during the one-year period in SYSC 23 Annex 1 11.1R |

|||||

Ceasing to meet one qualification condition and beginning to meet another |

|||||||

311.10 |

G |

(1) |

This paragraph deals with the following example |

||||

(a) |

a firm meets a qualification condition for being an enhanced scope SMCR firm and becomes an enhanced scope SMCR firm; |

||||||

(b) |

later the firm meets another qualification condition; |

||||||

(c) |

shortly after (b) the firm ceases to meet the first qualification condition; and |

||||||

(d) |

the gap between (b) and (c) is less than the one-year period provided for in Part 10 of this Annex. |

||||||

(2) |

In this example: |

||||||

(a) |

the firm never stops being an enhanced scope SMCR firm; and |

||||||

(b) |

neither the one-year period in Part 10 of this Annex nor the one year countdown provided for in SYSC 23 Annex 1 11.1R applies. |

||||||

Part Twelve: Opting up and opting back4 down |

|||||||

Opting up to being a core firm |

|||||||

312.1 |

R |

(1) |

A firm may notify the FCA in accordance with this Part that it intends to become a core SMCR firm. |

||||

(2) |

The notice takes effect three months after the FCA receives the notice. |

||||||

(3) |

A firm may only make such an election if the flow diagram in SYSC 23 Annex 1 1.2R (Flow diagram: Types of SMCR firm) allows this. |

||||||

312.2 |

G |

The flow diagram in SYSC 23 Annex 1 1.2R (Flow diagram: Types of SMCR firm) means that only a limited scope SMCR firm may opt up to be a core SMCR firm. |

|||||

Opting up to being an enhanced scope firm |

|||||||

312.3 |

R |

(1) |

A firm may notify the FCA in accordance with this Part that it intends to become an enhanced scope SMCR firm. |

||||

(2) |

The notice takes effect as described in Part 10 of this Annex. |

||||||

(3) |

A firm may only make such an election if the flow diagram in SYSC 23 Annex 1 1.2R (Flow diagram: Types of SMCR firm) allows this. |

||||||

312.4 |

G |

The flow diagram in SYSC 23 Annex 1 1.2R (Flow diagram: Types of SMCR firm) means that only a limited scope SMCR firm or a core SMCR firm may opt up to be an enhanced scope SMCR firm. |

|||||

312.5 |

R |

(1) |

An enhanced scope SMCR firm that is within the one-year period in Part 11 of this Annex (When a firm stops being an enhanced scope SMCR firm) may notify the FCA in accordance with this Part that it intends to remain an enhanced scope SMCR firm. |

||||

(2) |

The notice takes effect immediately on receipt by the FCA. The effect is that: |

||||||

(a) |

the firm remains an enhanced scope SMCR firm; |

||||||

(b) |

the three-month period in Part Ten of this Annex (When a firm becomes an enhanced scope SMCR firm) does not apply; and |

||||||

(c) |

the firm is treated as meeting the qualification condition for being an enhanced scope SMCR firm of having opted to be an enhanced scope SMCR firm under SYSC 23 Annex 1 9.1R(3). |

||||||

Opting up by applicants for permission |

|||||||

312.6 |

R |

(1) |

The following may also give a notice described in SYSC 23 Annex 1 12.1R or SYSC 23 Annex 1 12.3R: |

||||

(a) |

an applicant for Part 4A permission; and |

||||||

(b) |

other persons seeking to carry on regulated activities as an SMCR firm. |

||||||

(2) |

The notice becomes effective when it becomes an SMCR firm. |

||||||

312.7 |

D |

If a person in SYSC 23 Annex 1 12.6R(1) wishes to rely on SYSC 23 Annex 1 12.6R, it must make, or, as the case may be, amend its application so as to meet the relevant requirements of this Annex about the notices described in SYSC 23 Annex 1 12.1R or SYSC 23 Annex 1 12.3R. |

|||||

312.8 |

G |

(1) |

This paragraph relates to a person who is about to become an SMCR firm and wishes to opt up in accordance with this Part of this Annex. |

||||

(2) |

This Part of this Annex restricts who can elect to opt up to a higher category of SMCR firm. In a case covered by this paragraph, this restriction relates to the category of SMCR firm of which the person will be a member when it becomes an SMCR firm if it had not made the election. |

||||||

(3) |

(2) also applies to the requirements about how to notify the FCA. |

||||||

Revoking an opt up |

|||||||

312.9 |

R |

(1) |

This rule deals with a firm that has elected under this Annex to become a core SMCR firm or an enhanced scope SMCR firm and that election has taken effect. |

||||

(2) |

The firm may notify the FCA that it is cancelling its election under this Annex to be: |

||||||

(a) |

a core SMCR firm; or |

||||||

(b) |

|||||||

(3) |

A notification under (2)(a) takes effect one year after the FCA receives the notice. |

||||||

(4) |

A notification under (2)(b) takes effect in accordance with Part 11 of this Annex. |

||||||

Opted up firm later meets other qualification conditions |

|||||||

312.10 |

G |

(1) |

A firm may elect to opt up to a higher category of SMCR firm and then later meet one of the other qualification conditions for that higher category. |

||||

(2) |

The table in SYSC 23 Annex 1 12.11G gives examples of various scenarios that can follow on from that. |

||||||

312.11 |

G |

Table: Examples involving a firm that opts up a category |

|||||

Scenario |

Treatment under this Annex |

||||||

(1) A firm elects to opt up to a higher category. It later meets one of the other qualification conditions for that higher category. It ceases to meet that second qualification condition some time later. |

The firm remains in the higher category because its election remains in force. |

||||||

(2) A firm elects to opt up to a higher category. It later meets one of the other qualification conditions for that higher category. It later cancels its election. |

The firm remains within that higher category despite cancelling its election because it still meets that second qualification condition. |

||||||

(3) A firm elects to opt up to a higher category. It later cancels its election. During the one-year period in Part Eleven of, or this Part of, this Annex following its cancellation notice it meets one of the other qualification conditions for that higher category. |

The firm remains within that higher category despite the cancellation notice. |

||||||

(4) A firm elects to opt up to a higher category. It later meets one of the other qualification conditions for that higher category. It later cancels its election. Some time after that, it ceases to meet the second qualification condition. |

The cancellation notice has no immediate effect (see Example (2)). However when it ceases to meet the second qualification condition it ceases to be in the higher category. In contrast to Example (1), its election is no longer in force when it ceases to meet the second qualification condition. |

||||||

Note: When this table refers to the cancellation of an election it refers to cancelling that election after it has taken effect and not to withdrawing it before it takes effect. |

|||||||

Giving notices |

|||||||

312.12 |

R |

(1) |

This rule deals with a notification under SYSC 23 Annex 1 12.1R to SYSC 23 Annex 1 12.6R. |

||||

(2) |

The notification must be made in accordance with SUP 10C.15.11R (Method of submission: electronic submission). |

||||||

(3) |

A firm must use the version of the form made available for this purpose on the electronic system referred to in SUP 10C.15.11R, which is based on the version found in SYSC 23 Annex 2R (Form O). |

||||||

(4) |

If SUP 10C.15.11R requires the notification to be in accordance with SUP 10C.15.14R (Method of submission: other forms of submission), the firm must use the version of the form found in SYSC 23 Annex 2R. |

||||||

Withdrawing notices |

|||||||

312.13 |

R |

A firm may, by notice to the FCA, withdraw a notice in SYSC 23 Annex 1 12.12R at any time before it takes effect. |

|||||

(1) |

This paragraph relates to the withdrawal of a notice as described in SYSC 23 Annex 1 12.13R. |

||||||

(2) |

If a firm decides to give a withdrawal notice, it should send it to the FCA as soon as possible. |

||||||

(3) |

A firm should give a withdrawal notice in accordance with SUP 15.7 (Form and method of notification). There is no specified form for the notice. |

||||||

312.15 |

G |

See SYSC 23 Annex 1 11.7G for more about the effect of withdrawing a notice electing to be an enhanced scope SMCR firm. |

|||||

312.16 |

G |

If a firm notifies the FCA in accordance with this Part of this Annex that it intends to revoke its election to be an enhanced scope SMCR firm and then changes its mind within a year, it should withdraw its revocation notice under SYSC 23 Annex 1 12.13R rather than use the opting-up procedure in SYSC 23 Annex 1 12.5R. |

|||||