M2G 1.1 Background

1This guide sets out an overview of the FCA’s approach to transposition of the recast Markets in Financial Instruments Directive 2 (MiFID 2) in the MAR and REC sourcebooks. , by explaining how they fit within the context of the overall implementation of the legislation at a UK and EU levelThis guide focuses on the regulatory regime in MiFID 2 for trading venues (as defined by article 4(1)(24) MiFID 2: this term comprises regulated markets, multilateral trading facilities and organised trading facilities but not systematic internalisers) and data reporting services providers (DRSPs).

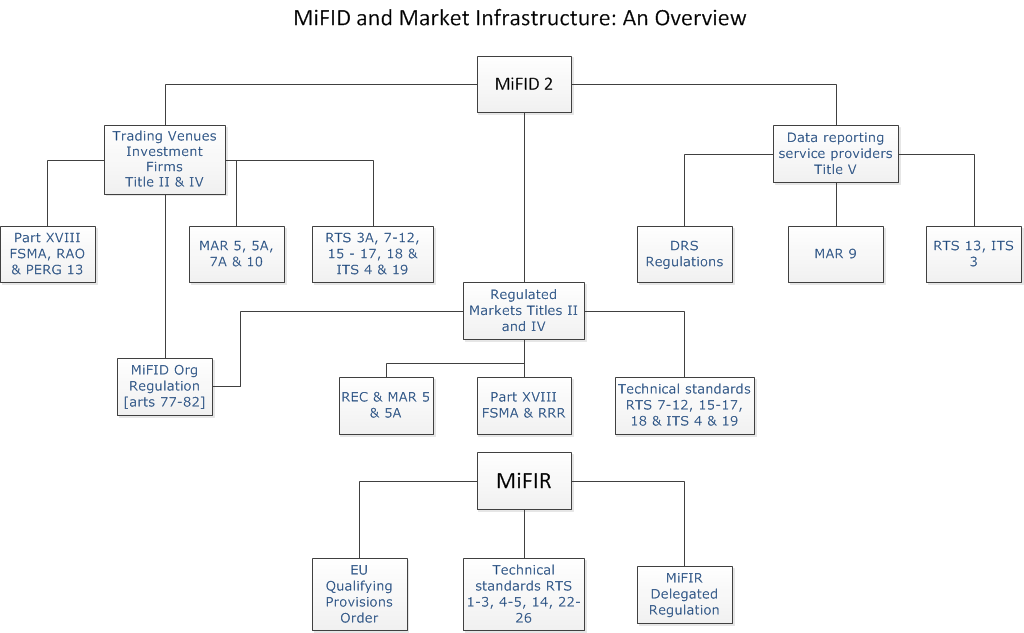

1MiFID 2 is made up of MiFID (2014/65/EU) and the Markets in Financial Instruments Regulation (MiFIR - 600/2014/EU). MiFID is addressed to all Member States and being a directive is binding as to the result to be achieved, albeit leaving the choice of form and methods of implementation to national authorities. The UK has implemented the directive through a combination of primary legislation, secondary legislation and regulatory rules. As an EU regulation, MiFIR is binding in its entirety and directly applicable, its content becomes law in the UK without the need for domestic legislative intervention.

1MiFID 2 enables the Commission to make secondary legislation in several places. That legislation takes the form of a combination of delegated acts (for example as provided for in article 4(2) MIFID to specify elements of the definitions), regulatory technical standards (RTS) and implementing technical standards (ITS). Delegated acts under MiFID 2 are both drafted and made by the Commission, after it receives advice from the European Securities and Markets Authority (ESMA), and may take the form of either directives or directly applicable regulations. As for RTS and ITS, these are prepared in draft by ESMA and subject to public consultation, before endorsement and making by the Commission; both take the form of regulations and so are directly applicable. RTS and ITS feature, in particular, in the MiFID 2 provisions relating to trading venues and DRSPs.

1You can be subject to a MiFID or MiFIR requirement, even if you are not an authorised financial institution. This is the effect of article 1 MiFID and article 1 of MiFIR. In the case of article 1 MiFID, this applies algorithmic trading requirements to certain persons exempt under MiFID, where they are members of a regulated market or multilateral trading facility (article 1(5) MiFID). Similarly, article 1 MiFIR requires non-financial counterparties above the clearing threshold in article 10 of the European Market Infrastructure Regulation (‘EMIR’) (Regulation 648/2012/EU. See our EMIR webpage (https://www.fca.org.uk/markets/emir) for further details about non-financial counterparties and the clearing threshold) to comply with the obligations in Title V MiFIR. This means trading certain classes of derivatives on organised venues only, regulated markets, multilateral trading facilities (MTFs), organised trading facilities (OTFs) and permitted third country venues (article 28 MiFIR).